Why Privatize? Who Do You Trust? - Updated

Social Security privatization proponents should have observed a nice weapon in this legislative battle this week, but they probably did not. United Airlines obtained a bankruptcy judge's approval to default on its four large pension plans which created the largest pension default in U. S. history.

Of course, you and I will pay. The Federal government has a pension insurance program, also running at a deficit ($23.3 billion). The Feds will pick up the tab.

What should not be overlooked here, however, is the clear question that should be asked in the Social Security debate. That is, what is the best way to protect an investment for retirement? There are three primary retirement plans.

1. The pension system. Under this system, a third party, presumably the employer, sets up their own contribution plan into a system that will provide benefits at retirement age for eligible employees. If the company uses the money improperly, or invests unwisely, if at all, or if the company goes broke, the employee gets nothing unless the government steps in to support the benefits. There is no guarantee that the company will honor the investment, nor that the government will fund the pension if the company defaults.

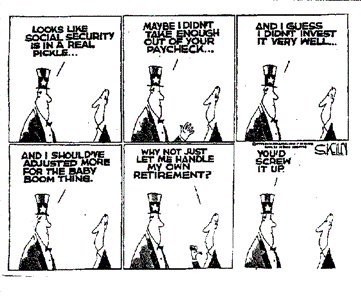

2. There is Social Security. This is just like the pension, except that the government does not even pretend to invest in the system, payouts are even more discretionary and no significant benefits flow to your heirs. At least with a pension, if the company is solvent, there is a contractual expectancy. Under Social Security, the government may, at its discretion, raise your eligibility age; cut your benefits; raise taxes on your benefits; or cancel the program altogether. There is hardly anything to your heirs if you die. Under the law, you have no right to expect any benefits - there is no obligation on the govenment to fulfill its "promise." The system is not properly funded or invested, so the future politician, facing an aging population and ever expanding government, will face political pressure to cut benefits in the future.

3. Finally, there is private investment. Most companies have abandoned pensions for defined contribution plans. The investment decisions are left to the employees. The left would have you believe that this is good for companies to offer, but dangerous for Social Security. The left also likes to treat the common person as an idiot, unable to care for him or herself.

The leftist politicians, however, opt out of Social security whenever possible and invest in private 401K or similar programs. Congress doesn't rely on Social Secuirty. Plus, the only plan on the table, sadly, only allows a small portion of your Social Secuirty taxes to be invested into a private account. The account is optional, so stupid or lazy people will not have to contribute to private accounts and face the boogy man of market risk. Moreover, one would only get to choose from regulated, limited and diversified investments.

[A]nd finally, beginning in 1949, twelve years from now, you and your employer will each pay 3 cents on each dollar you earn, up to $3,000 a year. That is the most you will ever pay.One could diversify with mutual funds. One could diversify among mutual funds. One could invest in T-bills, or put the money in a bank account, or other so called low risk investments. You could control part of your money that would be there if you retire, or die. Or, you could choose to stick with the 1% rate of return of Social Security, showing just how economically and mathematically uneducated you are. You can thank your government school for that education later.

--The 1936 Pamphlet on Social Security

While some facts on this issue are debatable, most really are not. Social Secuirty is no better than United's pension fund. The best, safest, most secure way to control your retirement is to put as much of it in the private, diversified investments of your choice that you own. The leftist politicians will not admit that, though that is what they do privately. Plus, privatized plans have done very well when tried in place of Social Secuity or similar programs. See here and here.

Most importantly, it does not really matter if Social Security is in crisis, or when it will be in crisis. Ownership of one's own retirement, and trusting the people of this supposedly free country to look after themselves, is just the right thing to do.

This whole Social Security privatization debate is a fraud.

But hey, what do these people know?

UPDATE:

Don Surber, writing for the Charleston Daily Mail, make a cogent argument and brings to light the Federal pensions and the new West Virginia decision to go market in their retirement accounts. He also calls on President Bush to come to West Virginia and dare West Virginia Senators KKK-Byrd and Rocky to call the Democratic state government reckless for its plan.

Which brings me to Democrats' phony opposition to the president's Social Security reforms. Democrats know better. The five richest senators are John Kerry, Herb Kohl, Jay Rockefeller, Jon Corzine and Dianne Feinstein. Democrats all. They have trust funds, not lockboxes.

Another Democratic senator, Barbara Boxer, is a former stockbroker. I am tired of the do-as-we-deem, not-as-we-indulge attitude of limousine liberals. But it is not just their personal accounts that they refuse to put in lockboxes. Federal employees already have the very choices President Bush wants to give all American workers.

The federal thrift plan boasts of returns that average 10 percent a year. By the end of 2003, the plan had $128 billion invested by 3.2 million people. State pension plans across the nation invest in Wall Street. With their $5.5 billion pension bond proposal, Democrats in West Virginia are promising voters that Wall Street will average better than 7.5 percent returns annually for the next 30 years. Most of that money will be used to shore up the teacher pension plan.

If Wall Street is good enough for their teachers, then it should be good enough for my kids, who will face 30 percent cuts in their Social Security when they retire. President Bush ought to visit West Virginia and endorse this pension bond plan -- and double-dog-dare Sens. Bob Byrd and Rockefeller to denounce the $5.5 billion pension bond as a "risky scheme."

Let John Kerry propose liquidating the federal thrift plan to protect federal workers from the next bear market. Let Sens. Boxer and Feinstein go home to California and demand that Calpers, the nation's largest public employee pension plan, sell off all

its stocks and bonds and put its $172 billion in a lockbox.Otherwise, let my childrent get the same break [I did].

2 Comments:

I trust the gov't to steal 15% of my income for however long it takes for SS to go bankrupt and never see any of that money back.

I trust the 15% of my income I invest in mutal funds over that same time period to bring in almost half a million dollars (in todays dollars) in annual income in interest alone.

What if I'm wrong? Even if I'm half wrong I think I'll survive on 250k.

My what a naive, trusting individual you are MM.

Post a Comment

<< Home